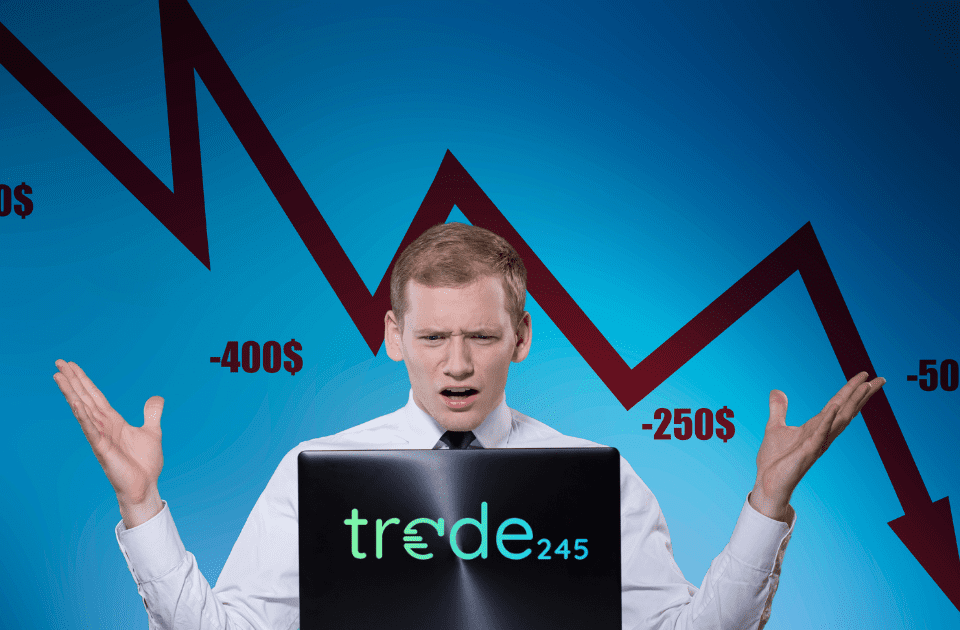

At Trade245, we know that protecting your capital is just as important as making profits.

That’s why we introduced “Stop Me Out” accounts — a unique way to help traders control their risk and manage how much they’re willing to lose.

These accounts provide an automated risk management feature that limits potential losses.

But what exactly is a “Stop Me Out” account, and how does it work?

ALSO READ: How to Contact Trade245 Support

What Is a “Stop Me Out” Account?

A Stop Me Out account is a special trading account that automatically closes all open trades once your losses reach a certain percentage of your deposit.

This helps prevent your account from going into a deeper loss and gives you better control over your balance.

You can choose between 20%, 30%, 40%, or 50% — depending on how much risk you’re comfortable with.

How Does It Work?

Let’s break it down with an example:

- You open a Stop Me Out account and deposit R500.

- You select the 50% Stop Me Out option.

- If your open trades reach a loss of R250 (50% of your deposit), all positions are automatically closed.

- You are left with the remaining R250 in your account.

It’s that simple.

You won’t wake up to find your entire deposit gone — the system cuts off losses at the level you set.

READ MORE: Top 10 Most Asked Questions About Trade245

Why Use a Stop Me Out Account?

✅ Risk Control

It’s ideal for traders who want to limit their downside, especially when markets are volatile.

✅ Peace of Mind

You can trade knowing there’s a safety net in place.

✅ Good for Beginners

If you’re still learning the ropes, Stop Me Out accounts give you a bit of breathing room without the stress of blowing your full balance.

How to Open a Stop Me Out Account

Opening a Stop Me Out account is easy:

- Log in to your Trade245 dashboard.

- Click on “Trading Accounts”.

- Select “Open New Account”.

- Choose the Stop Me Out account and the percentage you’re comfortable with (20%, 30%, 40%, or 50%).

- Fund your account and start trading with built-in protection.

Trade Smarter: Use Stop Me Out Accounts on Trade245

Trading always comes with risk, but with a Stop Me Out account from Trade245, you’re choosing to trade smarter.

You stay in control of your losses and protect your balance — without having to constantly monitor your trades.

If you’re someone who wants to trade confidently without risking your entire deposit, this account type might be just what you need.

Need help getting started?

Contact us here and we’ll walk you through the process.